Top OEM Suppliers for Solar Panel Clamps - Who Leads the Market?

2026-01-05

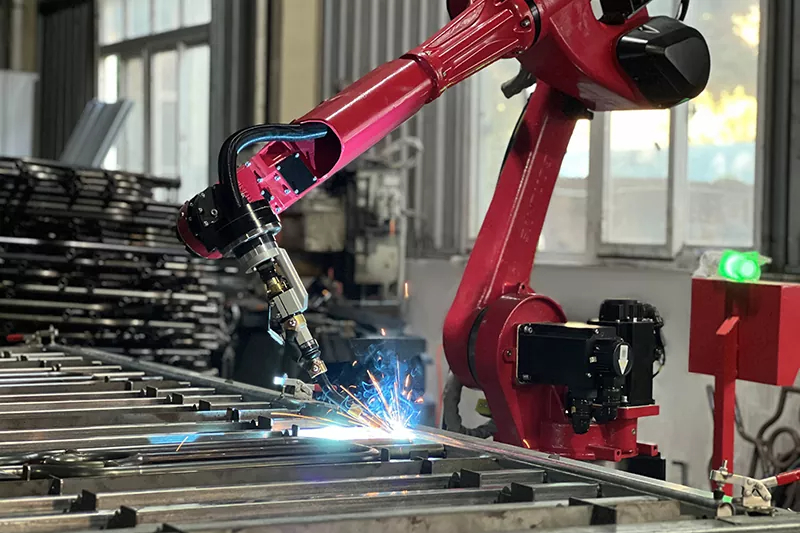

As the solar industry continues its rapid expansion, the importance of reliable mounting systems has never been more critical. Among these components, solar panel clamps play a pivotal role in ensuring the stability and efficiency of photovoltaic installations. In this blog post, we delve into the competitive landscape of top OEM suppliers for solar panel clamps, exploring who currently leads the market and what sets them apart. Whether you're an installer, project developer, or simply curious about the latest industry trends, this guide will provide valuable insights into the key players shaping the future of solar mounting solutions. At Topfence, we're committed to staying at the forefront of innovation, and we're excited to share our analysis to help you make informed decisions in this dynamic field.

Discover the leading manufacturers dominating the solar panel clamp market

As global demand for renewable energy surges, the solar panel clamp market has become increasingly competitive, with several key players establishing themselves as leaders through innovation, reliability, and extensive industry experience. Companies such as Schletter, IronRidge, and SunModo have built strong reputations by offering durable clamp solutions that ensure secure panel mounting in diverse environmental conditions, from residential rooftops to large-scale solar farms.

These manufacturers often differentiate themselves through specialized product features, like corrosion-resistant materials and easy-installation designs, which help reduce labor costs and enhance system longevity. Additionally, their commitment to research and development allows them to adapt quickly to evolving solar technology standards, providing installers and end-users with trusted components that meet rigorous safety and performance benchmarks.

By focusing on customer support and global distribution networks, these leading firms maintain a strong market presence, making them go-to choices for professionals seeking high-quality clamping systems that streamline solar project installations while maximizing return on investment.

How top suppliers innovate with durable materials and advanced designs

Leading suppliers in the industry are pushing the boundaries of innovation by combining resilient materials with sophisticated design techniques to create products that not only last but also perform exceptionally well in demanding conditions. They source high-grade polymers, alloys, and composites that resist corrosion, wear, and environmental stressors, ensuring longevity and reliability. This focus on durability minimizes maintenance needs and extends product lifecycles, offering value to customers through reduced total cost of ownership.

Beyond material selection, these suppliers leverage advanced designs such as computational modeling and generative AI to optimize structures for strength and efficiency. By simulating real-world scenarios, they can fine-tune components to withstand extreme forces while maintaining lightweight profiles. This approach leads to breakthroughs in performance, from enhanced load-bearing capacities to improved energy absorption, setting new benchmarks in safety and functionality.

Collaboration with research institutions and continuous investment in R&D allow top suppliers to stay ahead of trends, integrating cutting-edge materials like carbon fibers and smart textiles into their offerings. By prioritizing innovation in both durability and design, they deliver solutions that adapt to evolving market needs, fostering trust and long-term partnerships with clients across various sectors.

Key factors shaping pricing and supply chains in clamp manufacturing

In clamp manufacturing, pricing often hinges on raw material costs like steel and plastics, which can fluctuate due to global market trends and tariffs. Labor expenses and energy consumption during production add layers to the final price, while economies of scale allow larger manufacturers to offer competitive rates. Customization demands or compliance with industry standards, such as those for medical or construction clamps, further drive up costs, requiring precise budgeting to balance quality and affordability.

Supply chains in this sector face unique challenges, including sourcing specialized components and managing logistics for heavy or bulky items. Geopolitical tensions and trade policies can disrupt material flows, pushing companies to diversify suppliers or stockpile critical parts. Advances in automation and digital tools, like IoT tracking, help streamline operations, but reliance on overseas partners for cost savings introduces risks like delays or quality inconsistencies, necessitating robust contingency plans.

To stand out, manufacturers might integrate sustainable practices, such as using recycled materials or optimizing transport routes, which can lower expenses and appeal to eco-conscious buyers. Collaborative approaches with local suppliers can reduce lead times and enhance flexibility, fostering resilience against market shocks. By balancing cost-efficiency with innovative strategies, firms can craft supply chains that not only meet demand but also adapt swiftly to changing economic landscapes, securing a competitive edge in the clamp industry.

Market trends that set apart the best OEMs for solar installations

Top OEMs often lead by embracing emerging technologies like bifacial panels and smart inverters, which not only enhance energy yield but also integrate seamlessly with grid systems for better reliability. They invest heavily in R&D to stay ahead, adapting quickly to shifts in material science and manufacturing techniques. This proactive approach helps them deliver cutting-edge solutions that cater to evolving customer demands for efficiency and sustainability.

Another key trend is their focus on customization and scalability, allowing installations to be tailored to specific geographic and climatic conditions. By offering modular designs and flexible financing options, these manufacturers enable projects of all sizes to thrive, from residential rooftops to large-scale solar farms. This adaptability ensures they remain competitive in a market where one-size-fits-all solutions often fall short, fostering long-term partnerships with installers and end-users alike.

Moreover, top-tier OEMs prioritize sustainability beyond the product itself, implementing eco-friendly practices across their supply chains and lifecycle management. They often adopt circular economy principles, such as recycling old panels and reducing carbon footprints, which resonates with environmentally conscious stakeholders. This holistic commitment not only boosts brand loyalty but also sets a benchmark for the industry, making them standout choices for forward-thinking solar projects.

Insights into quality standards and certifications among industry leaders

In today's competitive landscape, industry leaders don't just chase quality; they embed it into their DNA through rigorous standards and certifications. Companies like Toyota and Apple, for instance, have long championed methodologies such as ISO 9001 and Six Sigma, not merely as badges of honor but as frameworks driving continuous improvement and customer satisfaction. These certifications serve as tangible proof of a commitment to excellence, fostering trust among stakeholders and setting a high bar that others strive to meet.

What sets top performers apart is how they integrate these standards into innovative practices, often going beyond baseline requirements. Leaders in sectors like aerospace and healthcare leverage certifications like AS9100 or FDA approvals to navigate complex regulations while pushing boundaries in safety and efficiency. By tailoring these frameworks to their unique contexts, they create resilient systems that adapt to market shifts and technological advances, ensuring sustained quality even under pressure.

Beyond compliance, industry leaders use quality standards as strategic tools to enhance collaboration and drive global expansion. Certifications like IATF 16940 in automotive or BRCGS in food safety enable seamless partnerships across borders, reducing risks and boosting operational synergy. This proactive approach not only strengthens brand reputation but also inspires a culture of accountability, where every team member is empowered to uphold these benchmarks, turning certifications from static documents into dynamic engines of growth.

Future outlook for clamp suppliers and emerging competitive strategies

The clamp supply landscape is poised for significant shifts in the coming years, driven by technological advancements and evolving market demands. With industries like automotive, electronics, and renewable energy increasingly relying on precision clamping solutions, suppliers must adapt to a more integrated and automated environment. This shift isn't just about producing more clamps; it's about embedding sensors and smart capabilities into designs to enhance functionality and meet the growing need for data-driven operations. Suppliers that lag in innovation risk being overshadowed by agile competitors who prioritize research and development, turning clamps from simple tools into critical components of larger systems.

In this competitive arena, emerging strategies are focusing on customization and sustainability as key differentiators. Rather than offering one-size-fits-all products, forward-thinking suppliers are leveraging digital tools and flexible manufacturing to create bespoke clamping solutions tailored to specific client needs. This approach allows for quicker turnaround times and builds stronger customer relationships, as clients see suppliers as partners rather than mere vendors. Additionally, with environmental concerns on the rise, companies are integrating eco-friendly materials and energy-efficient processes into their operations, not just as a regulatory compliance measure but as a core part of their brand identity to attract a more conscious market.

Looking ahead, collaboration and global outreach will play crucial roles in shaping the future of clamp suppliers. By forming strategic alliances with tech firms or other industrial players, suppliers can access new technologies and expand their market reach, staying ahead of competitors in a fast-evolving sector. This proactive strategy reduces reliance on traditional sales channels and opens doors to innovative applications, such as clamps in robotics or medical devices. Ultimately, success will hinge on a supplier's ability to anticipate trends, invest in talent, and foster a culture of continuous improvement, ensuring they remain relevant and resilient in an increasingly interconnected world.

FAQ

Solar panel clamps are fastening devices used to securely mount solar panels onto rails or other structures, ensuring stability and durability against weather conditions in photovoltaic installations.

OEM suppliers provide the original equipment for manufacturers, ensuring high-quality, standardized parts that are crucial for reliable solar panel systems, often with custom solutions and bulk pricing.

Companies like Schletter, Unirac, and K2 Systems are widely recognized as leading OEM suppliers, known for their innovative designs and robust products tailored to global solar projects.

They differentiate through features like corrosion-resistant materials, easy installation mechanisms, and compatibility with various panel types, along with offering extensive technical support and certifications.

Buyers should evaluate product durability, cost-effectiveness, delivery times, supplier reputation, and compliance with international standards like UL or IEC to ensure long-term performance.

Yes, top OEM suppliers often work closely with clients to develop custom clamp designs that meet specific project requirements, such as unique mounting configurations or aesthetic preferences.

Conclusion

The solar panel clamp market is dominated by a select group of top OEM suppliers who excel through robust manufacturing capabilities and innovative approaches. Companies like Schletter, Unirac, and IronRidge lead by integrating durable materials such as aluminum alloys and stainless steel with advanced designs that enhance installation efficiency and longevity. These market leaders prioritize quality standards and certifications, ensuring compliance with international norms like UL and TÜV, which bolster reliability in diverse environmental conditions. Their strategic positioning allows them to shape pricing and supply chains effectively, leveraging economies of scale and streamlined logistics to offer competitive solutions without compromising on performance.

Looking ahead, key market trends and the future outlook highlight a shift toward sustainability and smart technologies, with top suppliers investing in R&D for lightweight, corrosion-resistant clamps and modular systems. Emerging competitive strategies include digital integration for supply chain transparency and partnerships with solar installers to tailor products for specific projects. By focusing on innovation, quality assurance, and adaptive business models, these leading OEMs not only set themselves apart but also drive the industry forward, anticipating evolving demands in solar installations and maintaining their market dominance through continuous improvement and customer-centric approaches.

Contact Us

Contact Person: Nancy

Email: [email protected]

Tel/WhatsApp: +86-13365923720

Website: https://www.topfencesolar.com/